It’s been a while since I’ve done a monthly manufactured spending report, so I thought I’d share one now that my new MS routine is pretty much set. In October, I managed to liquidate about $20,000 worth of Visa gift cards. Less than that, really, if we want to round down instead of up.

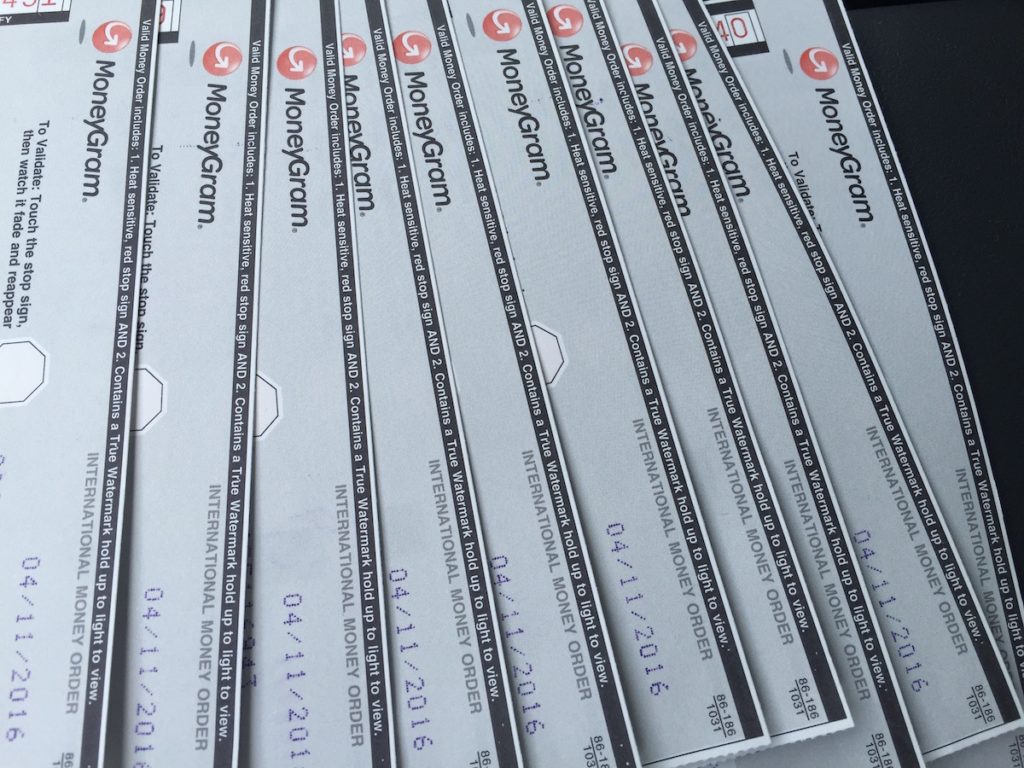

For the most part, I’ve been ordering Visa gift cards from gift cards.com whenever I’ve had the chance…which, evidently, wasn’t often. I made two trips to Walmart to liquidate these cards and that was pretty much all there was to it. Boring stuff, I know.

Here’s my new reality: Going forward, I can realistically manage just $40,000 – $80,000 worth of manufactured spending per month. I’m not saying that in a cutesy, self-deprecating way either. But considering I’ve done upwards of $323,000 in a single month before, $40,000 – 80,000 isn’t very much. I’ve had to dial it way back because I just don’t have time to dedicate to it.

When I started my job in May, I underestimated how much it would affect my MS routine. At the time, I wrote about how my favorite Walmart store was halfway between home and work. I thought I could easily stop by on my way home every night and liquidate some gift cards before continuing home.

The problem is that 5 PM and later is the busiest period at that particular location. I went there one day after work and the line was so long that I just left after 10 minutes. It was clear I would be there for at least an hour and that just wasn’t going to work for me.

This is going to sound totally contradictory to the mission of this blog, but I’m a homebody. I LOVE being home when I’m not traveling. Anything in between just interferes with my hermit tendencies. Do I want to spend 5 hours a week at Walmart? Not when I could be binge-watching Mindhunter on Nextflix. This is part of the reason why having a *real* job was so important. I literally won’t talk to another person for a week if I’m left to my own devices.

But I’m t getting off track here – the point is, we all prioritize how we spend our time. I would rather be home after a 7-hour work day and 1-hour commute than standing in line at Walmart.

Instead, I’ve been doing my MS runs on Saturdays. It’s usually pretty slow in the morning, so I’m able to get out of there fairly quickly. But do I want to go back on Sunday to liquidate another $10,000? No, especially not when I’m using weekends to play catch-up on my side-gigs.

“What about Walmart Bill Pay?” There was a time when Walmart Bill Pay allowed me to double up on the amount of MS I could do. The problem? Using it to make payments got my Barclay accounts shut down. So I’m done using it, even for payments on my Discover It Miles Cards, which have been MS-friendly so far. No need to test this out further.

That brings me down to $10,000 worth of manufactured spending a week. At least when it comes to the Visa gift card/money order route. Merchant gift card churning season (i.e. the holidays) is almost here, which means I’ll probably start churning around $20,000 worth of merchant gift cards from home.

Last year, I did pretty well thanks to The Plastic Merchant sending out email updates when good gift card deals came around. I even found some on my own, then managed to sell them with little competition. This was a really convenient way to churn gift cards without even leaving the house.

It works out even better now that I don’t have 10 hours a week to dedicate to this hobby. So I’m looking forward to being able to shift my focus to merchant gift card churning again.

I want to hear from you: How did you do last month and how do you manage to churn gift cards with other stuff going on?

[jetpack_subscription_form title=”Subscribe via email for more points, miles and free travel”]

Wish I had a friendly WM close to me. In the meantime, TPM may be my friend. Anyway to overcome the volume restrictions other than having multiple eBay accounts?

same feelings….the MS life would be much easier if any friendly WM around me.

Ebay isn’t the only place to buy gc’s. Sam’s Club, Costco, Staples, Best Buy – they’re all going to be offering substantial discounts on gift cards any day now.

I’m curious to know your MS cost on the $10k. I’ve dabbled in MS, but only when I find deals on Visa GC at OF/OM/Staples. Also, what cards are you MS spending on? I read on a different blog not to do it with your SPG card, but if you sprinkle in lots of real spend with MS is it less likely to get flagged?

I used to earn a small profit doing this, but lately I’m spending about $19 per $2500 through giftcards.com

What’s your approach for ordering $10k of MO in one shot at Walmart? You just tell them want to do 10 ~$1k MO transactions at $500 per swipe and say ok when they ask to log your personal info in their book? What info do they ask for?

They know me now, so I don’t even have to tell them anymore: five transactions for $2k (including fees) each. Four swipes per transaction, and I don’t mind filling out the paperwork since they keep that stuff secure.

How did this start? Did you just tell them you were buying gift cards for cc points? Were they apprehensive?

Most of us are following these ideas so we can get the most out of life by traveling (within our budget). It’s refreshing that you reminded me that MSing into exhaustion may defeat the whole purpose. ThankQ for your candor and continuing your Blog, MS, and new full-time job!

Thanks Dawn! I’m glad you find this blog useful. 🙂

350k+ last month. 400k+ this month. Busy!!

No wonder we missed u at Chic Seminar.

Greetings From Augusta !!

Dj

Wow! You’ve officially outdone my all-time best Congrats!

Jeff, I’m curious as to how you liquidate so much. If it’s with MO’s, how do you do so many without being flagged by the finCEN? Crazy numbers too, man!

Adam, some traditional liquidation discussed here and some not discussed. Some of it also depends on where you live and what options you have. I talk about MS a bit more as well as other things on my blog as well, thanks

Not sure why my website didn’t appear, but I’ll try it again: http://millionmileguy.com/

Thank you for sharing this, Adrianna. Really appreciate your blog. How do you liquidate the mo’s (assuming you follow the “don’t sh*t where you eat” adage when it comes to Chase, etc.)?

I deposit the mo’s into my WF checking account, then pay off my cc balances.

Thanks for the update Ariana.

Sure thing!

I’m shocked that you can do a measly $20k per this past month.

I want to hang out with you on a Saturday morning. Heck, I’ll cover the coffee and gas!

Lol! I’m down.

I’ve been doing less and less MS for the same reasons. I work near two Walmarts but I totally hate going there for MO’s. Especially when the occasional rep gives me an attitude or if there’s a long line. Let’s be honest, Walmart does not give you a warm, fuzzy feeling. I would probably try a lot more MS if I didn’t have a full time job, but I’d rather have a nice job and have the ability to spend a little more than no job and just MS full time.

In my case, the staff is really awesome and friendly. It’s just the 5 PM lines that are too much sometimes.

Glad you brought up giftcard reselling and the upcoming season. Thanks to your encouragement, many of us have done well with TPM, for the most part. Your reference to TPM sending out email alerts reminded I hadn’t seen one of them since….. October 1st. (!) Turns out I’d missed an “important” memo about the “seller profile” link — and that I can now get text updates ….. whew!

My one concern remains in the realm of payment….

a. the often long lag time between card submission, ten-day apart payment dates, and snail-mail check payment and

b. the very REAL threat of mail getting misdirected — (“thanks” to Amazon overloading the USPS) I’ve had several checks apparently sent to wrong addresses, then redirected….

Rather puzzling, since several of TPM’s competitors offer what for me has been flawless ACH payments on card sales, within days/hours of cards selling. (and I now get very competitive bulk seller discounts…. I’d have done far more business with TPM — except for the payment drag issues.)

I seem to recall seeing a message somewhere that TPM is giving more timely ACH service to ultra large volume sellers. (rather annoyed that “they” get it, but the rest of us don’t….. and rather ironic since TPM prides itself on having “equal rates” for approved sellers. Alas, that equal treatment apparently doesn’t apply to how we get paid…..

Again, I really like TPM, and am grateful to you for opening our eyes on this one….. Wish I could meet up with them in Chicago next week….

I need to sign up for that text alert because I’m bombarded with emails and tend to ignore most of them. The payment issue is something a lot of people have concerns over. I don’t know what’s behind it, but I hope it gets sorted out in time for churning season.

You may get “equal rates” but you don’t have access to equal brands or even ability to reserve. It’s really a sham system. Mike can play favorites as much as he wants, it’s his business, but eventually it’ll all come tumbling down on him and his sellers. You have no idea how many sellers he’s hosed over – it’s clear ever since he shut down his channel, folks can’t communicate or know who one another are. His checks were routinely late, I even heard some had bad checks written to them. Now THAT is scary.

Hi, You may want to check the links to the Beginner’s Guide since many of them don’t work. The insurance company links for AA and Delta may not be working as well. The Guide to MS is out of date. Can you please explain what and how your are purchasing and spending so much on gift cards? I feel like I am missing a critical part to understanding how this works. Thank you.

Thanks for the heads up. I’ll be updating the entire guide soon. I’ve done quite a few posts on gift card churning. This guide might help: https://www.pointchaser.com/manufactured-spending-everything-to-know/

So the guy doing 400K a month is spending $3000 in fees and spending at minimum 30 hours (~$1,500) doing this? Meh. Its a good deal….but thats all it is. A good deal. Still shelling out a fair amount of cash and time. Best to just start a business and expense everything. This way you are MAKING money and miles instead of spending money to get miles

@Benji – not spending $3k in fees a month. Not even close.

Nope, far less than that. I’ve explained the fee breakdown in a couple of posts, but I think an update might be in order.

The guy doing $400k+ kind of hard to believe…took a look at his site via the link here and he seems very negative about MS….hard to believe he was not just plugging his site….

@Merotra, 400k+ is absolutely doable. There are others doing more volume than that. I’m by no means near the top of that mountain. And no, I wasn’t just plugging my site, but I do appreciate the ability to do so – even on another site, thanks Ariana

@Merotra, The 400k+ guy is absolutely the real deal. My husband and I met him last year, and he generously gave us a crash course on msing for “dummies,” which is what we were at the time. If I wanted to commit the time (daily runs), I could easily do 300K a month (without counting new credit card sign up bonuses and without counting points my husband accumulates) If you read some of his older posts, you would see he actually did a post itemizing the points he accumulated for the last year. He’s been doing this for a while, and his ability to collect huge numbers of points reflects that. He’s got a book in the works, so it may be a worth looking into if you want to learn more about how he does it.

Which guy are you referring to? I’ve done $300k+ in a month and it’s absolutely feasible if you have the right resources in place: https://www.pointchaser.com/successful-manufactured-spending/

I’ve been doing 95k per month for the past several months. Here’s the breakdown:

20k Starwood Preferred Guest

20k Chase Freedom Unlimited

20k Alliant 2.5% Visa (3% 1st year)

15k Fidelity 2%

10k Citi Double Cash

10k Barclay Arrival Plus

I was doing 20k on Cap One Venture Rewards but that account got shut down. My first shutdown in three years of relatively high volume MS. I think what got me was opening a Cap 1 360 account for the $300 bonus and using the balance to make a credit card payment once the bonus hit.

I was doing 15k per month on Discover It Miles but my year of 3% ended and I closed the account. Pushed 120k through that card for the year. I would like to apply for this card again but I’m not sure if you can get the double miles for a second time. Does anyone know?

My credit union that I was pushing 100k + through monthly called me recently to inform me that I could no longer deposit money orders there. They didn’t close my account. Told me I could deposit cash but no checks or money orders. They knew I was engaging in MS but said that the high deposit amounts were raising red flags for their auditors and that they were losing money on my account because it cost them to process so many money orders. Also, the money was in and out of the account too fast. I have since opened four bank/CU accounts to spread the deposits around better. I let my deposits sit for at least a week before making any payments and I leave 3 or 4k in the accounts at all times. Hopefully I can avoid shutdown.

It also helps that I have a very MS friendly WM that lets me get as many MOs as I want without any paperwork. Hope that doesn’t change anytime soon.

That’s awesome! I love hearing reader MS stories like this.

Brand new to this whole MS game, but loving all the content on your site. Thank you!

Quick question(s): What about buying the gift cards from Walmart in the first place and then using them for money orders? Is there a reason you would want to get your gift cards elsewhere? I ask because my credit card has 5% back at Walmart this quarter, so it seems like a good option.

Thanks Andy! You can definitely buy the cards from WM but they’re just a little more expensive ($4.95 per $500). I like using giftcards.com because after the cash back portal payout, the fees are reduced significantly. But if you’re buying gc’s at WM with a category-bonus card that codes WM as a grocery store, then it can be worth it.

Just wondering what other sites people are using besides TPM for GC churning? Do they have minimums that are easy to meet (if they have minimums at all?). My main hiccup is finding a good deal and it’s limit 1 (or 2 or 3) per seller. Unless you have a ton of accounts (which I don’t), its hard to do this with regular success.